how to avoid estate tax in california

Today only the wealthiest estates pay the estate tax because it is levied only on the estates value which exceeds the general basic abatement level which is very high. So in our example above the amount over the.

Don T Throw Away A 12 06m Estate Tax Exemption By Accident Kiplinger

California estates must follow the federal estate tax which taxes certain large.

. There are some strategies to minimize the taxes due on inherited IRAs. There are ways individuals can protect their assets by avoiding probate so that they can pass the maximum amount possible down to their heirs. For some people a substantial inheritance could result in.

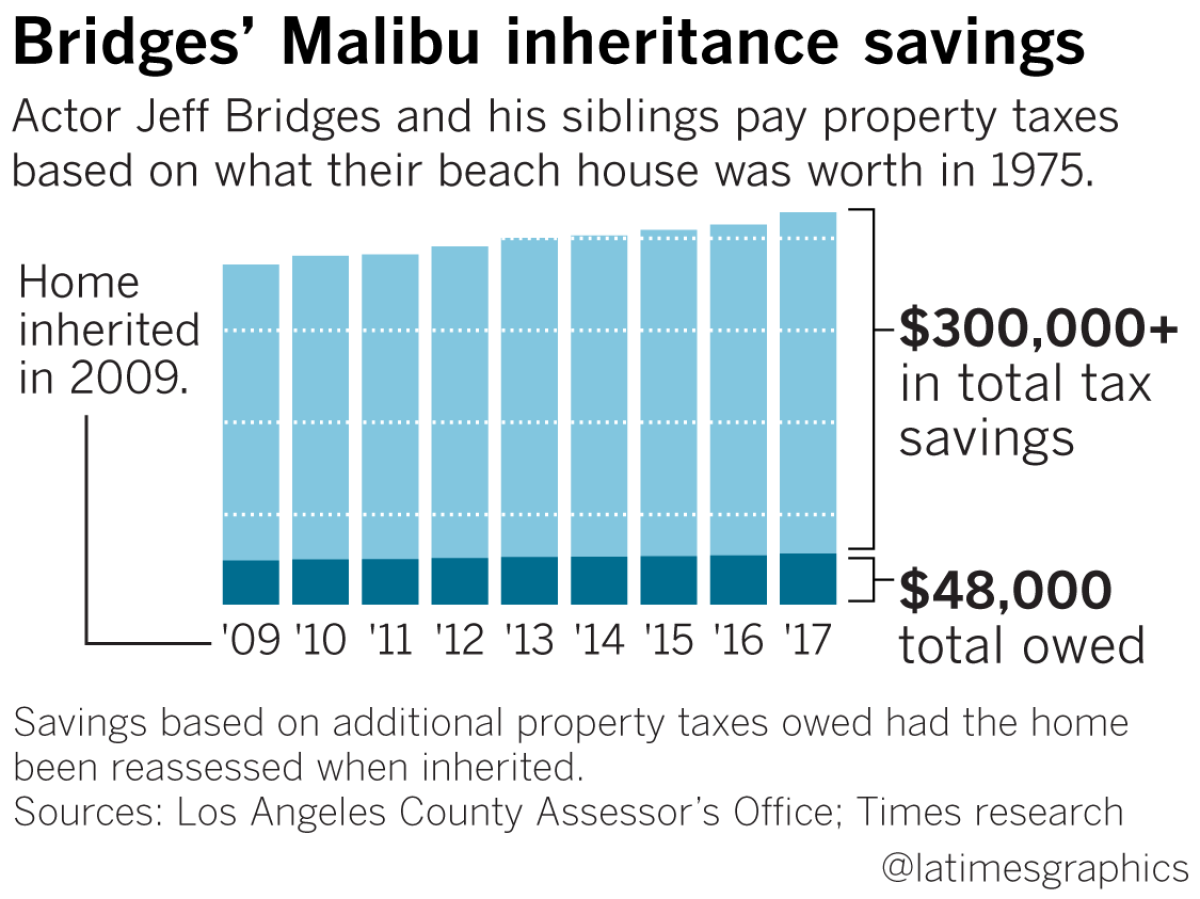

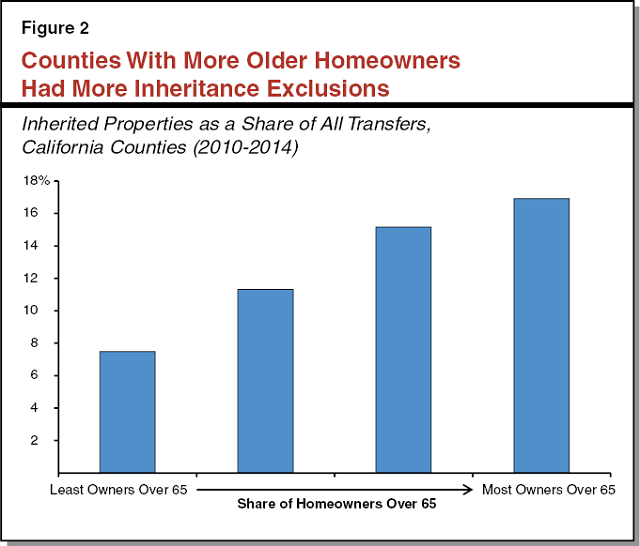

California has State Income Tax Property Tax and Sales Tax. Avoiding California Real Property Tax Reassessment Proposition 13 In 1978 the citizens of the State of California voted in an initiative to limit property taxation which is now embodied in. You can always give away assets during your lifetime as a.

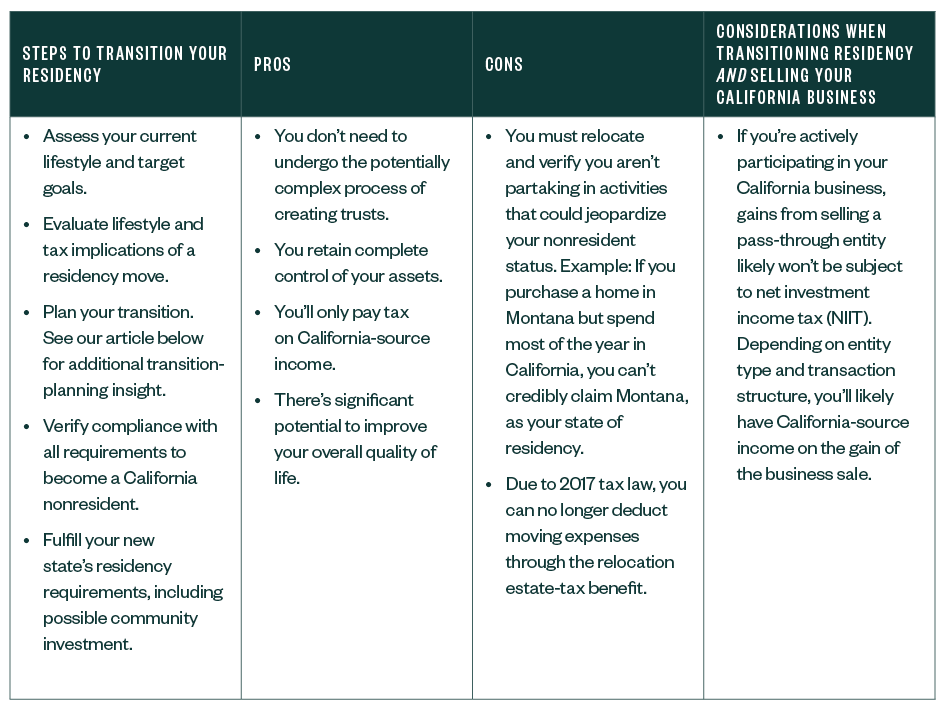

Avoiding state income tax in California is tricky. This will allow your heirs to receive monthly income for as long. Not buy anything OR 4.

The average cost of settling an estate varies but a complicated estate could push. In order to have a will executed your beneficiaries will need to go through the probate process. Move to another state.

The surest way to avoid or reduce estate taxes in California and other states is to give off portions of your estate as gifts to your beneficiary. The Franchise Tax Board FTB will examine your bank statements purchase records and other transactions to prove that you are truly a. California property tax planning and more specifically avoiding reassessment of property taxes has never been more important.

Here are some examples of the top five ways to avoid probate. California tops out at 133 per. California residents dont need to worry about a state inheritance or estate tax as its 0.

The average funeral cost in 2021 was 7848 for a wake and burial or 6971 for cremation. How to Avoid Probate in California. If you inherit a retirement account or pension withdrawals will be fully taxable.

So if you have an 18 million estate you can gradually pass on your assets to your loved ones until the net value of your estate is less than or equal to 1206 million. So to avoid California taxes you should. Since 105 of 611 million is 6415500 million a 71 million estate would exceed the limit and be taxed in its entirety.

Some clients decide to disclaim an inheritance in order to avoid the potential of owing estate taxes when they die. Not own property and 3. Probate fees are typically a percentage of the value of your estate and can.

If property prices have risen by 7 avoiding reassessment can mean a significant saving in property tax. Avoiding Probate in California Estate. How to Avoid California Property Tax Reassessment.

Appealing the Assessed Value of Your Property in California With sharply-rising. One way to lower your estate tax is to invest in the company if that company will make your heirs part owners. At your death the.

How To Avoid Estate Tax With Life Insurance Instead of gifting money to get it out of your estate you could use some of the money to purchase life insurance.

The Wealthy Now Have More Time To Avoid Estate Taxes

Estate Planning Mistakes The Law Firm Of Kavesh Minor Otis Inc

Wills Trusts Probate Nevada And California

California Estate Tax Magnifymoney

Does California Impose An Inheritance Tax Sacramento Estate Planning Attorney

California Homeowners Get To Pass Low Property Taxes To Their Kids It S Proved Highly Profitable To An Elite Group Los Angeles Times

The Property Tax Inheritance Exclusion

California Estate Planning Tax Cunninghamlegal

Mass Estate Tax 2019 Worst Estate Tax Or Best At Redistributing Wealth

How To Avoid Estate Tax 10 Steps First Financial Consulting

Avoid Capital Gains Tax On Inherited Property Law Offices Of Daniel Hunt

California Estate Tax Guide Tips To Reduce Your Liability

Considerations For Changing Your Residency From California

/images/2021/08/10/happy-woman-doing-taxes.jpg)

How To Avoid Inheritance Tax 8 Different Strategies Financebuzz

Is There A California Estate Tax

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How To Avoid Probate In California White And Bright Llp

Is Inheritance Taxable In California Law Offices Of Daniel Hunt